Lagardère update: 2023 should see a record current operating income of integrated companies

Travel retail doing great and publishing holding the line

First, as a reminder here is the link to the previous post about Largardère and its valuation:

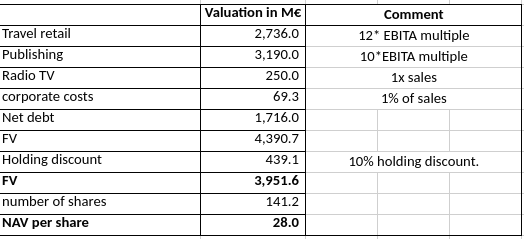

Lagardère : a sum of the parts valuation of 28 € which offers a margin of safety

So we know that Vivendi did an initial offer to buy Lagardère at 25 € (25,5 € with the dividend) and that there is a subsidiary offer at 24,1€ until the 15th of December 2023. This is the floor valuation. But it is probably worth more. Here is an attempt to get a fair value.

Two business units: Publishing and travel retail

Lagardère has two business units: publishing (the one Vincent Bolloré is after!) and travel retail. Publishing is a straightforward business: signing authors and publishing their books and hopefully have many hits.

Travel retail is managing shops which are inside airports, train stations... For that they have a concession (they pay the airports, train station the right to set up their shops), it is up to them to have brands which attract tourists or transit passengers who usually have a stronger buying power. They often have co-companies with the licensor and are partners through associated companies. Margins are lower (4%) with all the different expenses (paying the concession, investing in setting up the shops..).LEaP program will help travel retail margins as they keep cost cutting and productivity initiatives.

Both BU’s have a unique positioning. In publishing, they are an international actor and are the 3rd publisher worldwide of general public and educational books. In travel retail they are present on all the segments (2nd world operator in travel retail in airports, world leader in travel essentials, european leader in fashion travel retail, 4th in core duty free in airports and 4th in foodservice ) and in publishing they have an international presence which was lacking with Editis.

Publishing business will be impacted by the price of paper on the expense side. On the sales side, it all depends on the publishing of blockbuster authors, famous brands (Astérix comic books…).

What did we learn through the Q3 numbers?

In France, publishing is down 5% due to the absence this year of a Guillaume Musso book compared to last year (showing the importance of big names a little like the music industry!). Publishing should nevertheless have the same result as last year. Q4 in France should be slightly better then Q3 with important books coming out, UK should have a strong Q4. For the US it is still difficult in a sluggish market.

Travel retail had good results thanks to a boosted activity in regional airports (Marseille…) in France, Italy and in Poland. North America was helped by the return of Asian passengers especially in Canada. Foodservice now represents 25,7% of travel retail sales due to Marché International AG in Germany. Duty free and fashion is the top contributor in sales with 38,7% and travel retails sits at 35,5%. They are trying to bring a certain balance between the three segments.

No slowdown in travel retail

For Q4, the trend looks fairly good. In Q3, July had +16%, August +10% and September +14%. This trend will continue. Management doesn’t see any slowdown and they recommend comparing the numbers to 2019 (pre Covid).

As a reminder, Vivendi has a put option which can enable them to get up to 80% of Lagardère. Lagardère will remain quoted.

Debt level by end of year will remain unchanged and it takes into account the recent acquisitions.

Radios are made autonomous within Lagardère and under Arnaud Lagardère’s management

These assets have been put in partnership limited by share. To simplify, Arnaud Lagardère manages them and will b the ultimate decision maker concerning the editorial policy.

2023 should see a record RESOP and a sustainable growth is possible without any M&A

Management is aiming for a record current operating income of integrated companies (RESOP). It will be higher than last year. RESOP is a specific operational indicator. Basically it is the current operating income from which is deducted the contribution of equity-accounted companies before impairment losses

Optimistic forecast and strategic plan

They are working on a strategic plan and a financial budget for the next 5 years. Forecasts look really great and they are really optimistic about the future. They can do acquisitions but they can do without them to deliver sustainable growth in the coming years.

Next step to follow: December 2023 with the end of the Vivendi offer

Next step will be after December 2023 when the option of Vivendi on Lagardère will have ended. The subsequent offer enables sellers to sell to Vivendi at 24,10€. It will be interesting to see which amount they will get through this offer especially with the current market conditions…

Good incentives for the CEO and the management : FCF,ROCE, operating margin

There are three criterias for the variable income: FCF, Résop and operating margin. The latter was added in 2022 as it aligns all the criterias on those of the group’s long term variable remuneration for the management.

Performance shares will be attributed if goals are met concerning ROCE on the last year of the reference period,accumulated FCF on the reference period, a target operating margin rate being hit on the last year of the reference period.

Better be at the Lagardère level rather than at Vivendi

In my opinion Lagardère is the better place to be for the following reasons:

Two important minority shareholders (Bernard Arnault and Qatar) who have their views set on travel retail and which should ensure everyone has a good deal.

The initial and subsequent Vivendi offer gives us an objective market value of 25,5€ (main offer) and 24,1€ (subsequent offer which lapses on the 15th of December 2023) compared to the current 19€ share price.

1,3€ dividend which is probably recurring as some Lagardère owners expect their dividend. It gives us a nice 6,8% dividend yield with a 19€ share price.

A reasonable fair value can be estimated at 28€ (compared once again to a 19€ share price).

Cheers!

Jeremy

In the meantime, thanks again for signing up and feel free to talk to your friends / fellow investors about the French Hidden Champions Substack. You can also reach out by email or by DM on Twitter @FoxCastlehold.

Disclaimer: The above article constitutes the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in the Bolloré Galaxy entities and in Lagardère at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).

So can we buy it now at 19 and sell for 24 to Vivendi in December? What is the catch? Can Vivendi opt not to buy our shares? If you could share the terms of the offer would be great!

Thanks for the update