So we know that Vivendi did an initial offer to buy Lagardère at 25 € (25,5 € with the dividend) and that there is a subsidiary offer at 24,1€ until the 15th of December 2023. This is the floor valuation. But it is probably worth more. Here is an attempt to get a fair value.

There are two main BU’s:

Publishing with Lagardère Publishing (Hachette…) which is 1st publisher of general public and educational books in France and 3rd in the world

Travel retail with Lagardère Travel retail which holds the 5th global commerce operator in transport zones, the 2nd global operator in airports, and the 1st pure player present in all 3 business segments

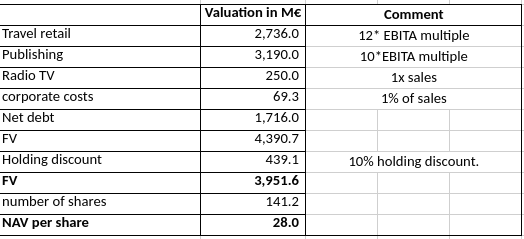

Valuation will be done by using multiples so we know the caveats with this type of approach. I took into account a 10% discount holding.

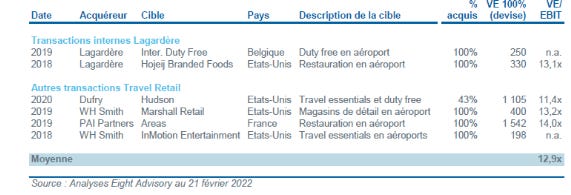

Travel retail has a good position in airports which tend to have clients with higher buying power and enables to have nice brands. This BU is a big beneficiary of reopening and air traffic back at a normal level.

Add to that a 1,3 € dividend (6% dividend yield with a 21,7 € share price) which should be recurring as some important minority shareholders need their dividends. The dividend level is capped at 1,3€ for 2023 unless the leverage ratio goes below *3,5. In other words, the dividend could be higher if the debt situation improves.

Business plan for publishing was predicting a 1,8% annual growth in sales for the 2022-2024 period and for travel retail 3,7% for the 2019-2024 period. Let us look at what happened all the way up to H1 2023.

Publishing is above the BP targets: 2,6% //1,8%

Travel retail is very clearly above the BP targets: 11,6%//3,7%

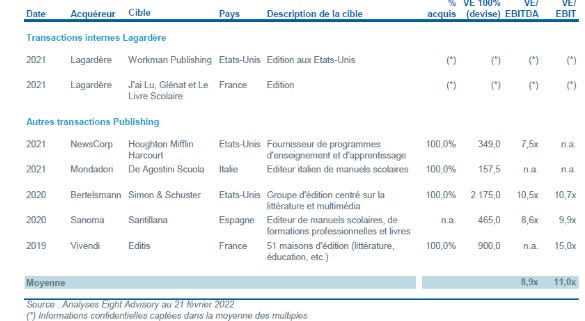

Sales multiple in the publishing business vary. Simon & Shuster was initially sold 2,2 billion USD to Penguin Random house (8,9*EBIT, 1,9*sales), a 10*EBITA multiple seems fair. Yet Simon & Schuster was finally sold to KKR for 1,6 billion USD giving us some depressed multiples (6,5*EBIT, 1,4 sales multiple) or more or less 7,6*EBITA multiple. Yet we know that Paramount was a forced seller and Penguin Random House is a major publishing player which makes it fair in my opinion to retain the 2,2 billion USD price tag (roughly a 10* EBITA multiple).

According to the independent expert report and the recap of publishing deals, the average EV/EBIT was at 11 so significantly higher than the Simon & Schuster deal (be it the Penguin Random House offer or the KKR offer).

Here is the sample:

The biggest acquisitions seem to command higher multiples. All in all the 10*EBITA multiple seems fair to value Lagardère publishing.

For Lagardère travel retail, average EV/EBIT transactions took place at 12,9 multiple. The 12*EBITA multiple which I used appears conservative.

28 € per share appears to be a conservative fair value for Lagardère. Remember that for the Vivendi sum of the parts I used the price offered by Vivendi in its additional offer (24,1€).

For those who are worried by a potential squeeze out or non alignment initiative (which won’t happen IMO), remember that there are two solid minority shareholders (Bernard Arnault and Qatar) which will ensure that if something happens a fair price will be offered

Cheers!

Jeremy

In the meantime, thanks again for signing up and feel free to talk to your friends / fellow investors about the French Hidden Champions Substack. You can also reach out by email or by DM on Twitter @FoxCastlehold.

Disclaimer: The above article constitutes the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. Disclosure – I hold a position in the Bolloré Galaxy entities and in Lagardère at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).

Interesting company, thanks for highlighting it.

I'm wondering if the opportunity cost could be very high and not worth the relative safety of this investment. Both Bolloré and Arnault are known to be patient (I'm less aware of the Qatar fund habits). They could wait years before squeezing out the company without any large risk. At worst one of these "big" minority shareholder would sell some shares on the markets.