Robertet (1)

A global leader in natural fragrances, flavors and ingredients

Grasse is a small scenic city located on the French Riviera, which is also known as the perfume capital of the world. It is home to 2 hidden champions in the flavor and fragrance industry. One of them, Robertet, is a 171-year old company.

Grasse has been the epicenter of the global perfume industry for at least 3 centuries but the story of Robertet starts in 1850. Jean-Baptiste Maubert and his uncle then built a factory, later acquired by Paul Robertet in 1875, which was the foundation of today’s company.

Over the years, Robertet has mastered the art of extracting and distilling essences and oils from flowers traditionally grown in Grasse (roses, lavender, jasmine...) as well as from other raw materials from all over the world.

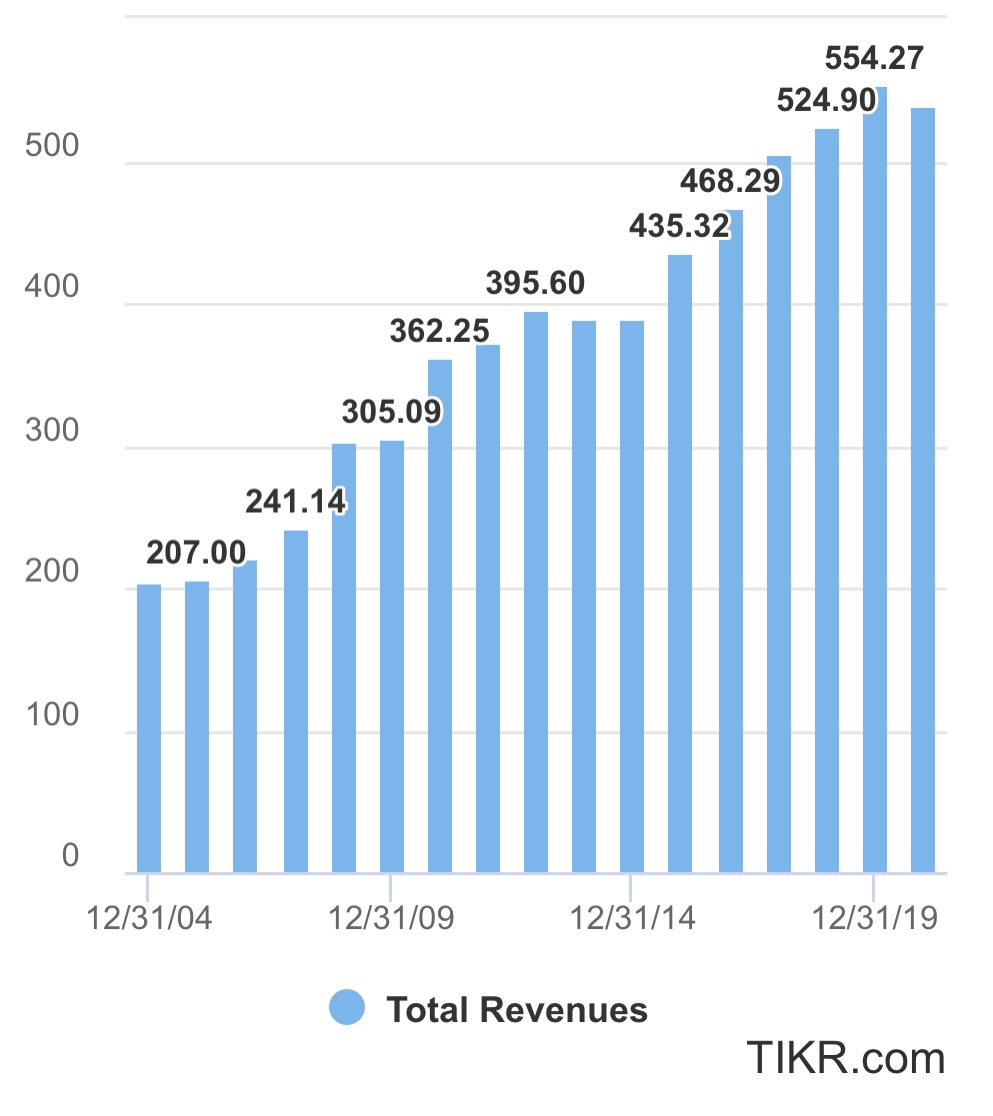

The ever-growing appetite for organic / luxury products has made Robertet a must-have supplier for the perfume, food, beauty and health industries. Following a stellar growth trajectory, the company has become the world leader for natural, organic and sustainable ingredients, fragrances and flavors with €538m in revenues for FY20, incl. 66% outside Europe.

This leadership has been achieved through a combination of organic growth, successful acquisitions on every continent and a strong focus on R&D/innovation. Robertet now boasts 14 creative centers and 30 manufacturing sites globally where it processes raw materials sourced from 60 countries.

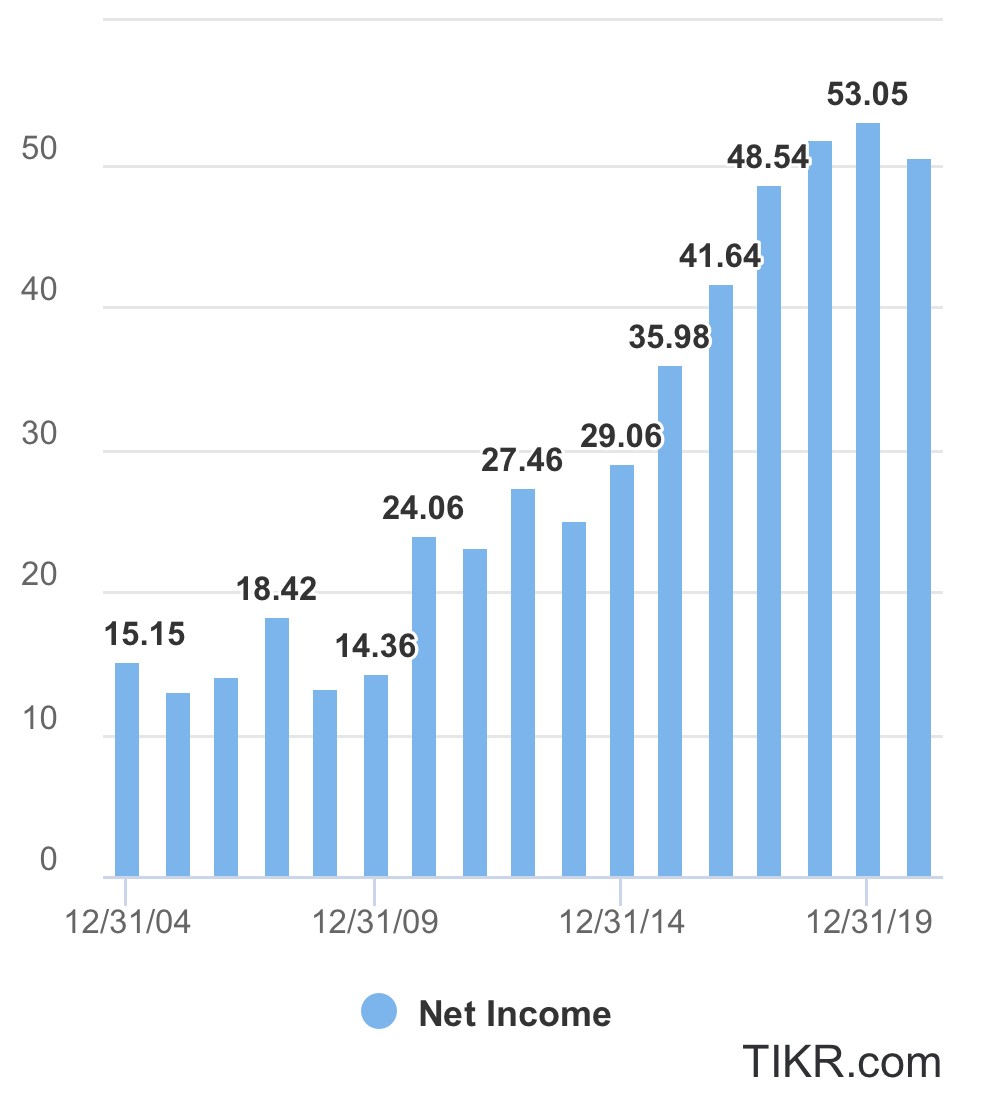

Over the past 16 years, Robertet has grown its net income at an annualized 8% clip to €51m in 2020 (see chart below). It still remains 47%-owned by the Maubert family and also enjoys a net cash position. As you would expect, such flawless business and financial track records have attracted its largest competitors’ attention.

What makes Robertet very valuable is the scarcity of similar sizable « moaty » pure players in the natural ingredient/flavor/fragrance space. This is why its larger Swiss competitor, Givaudan, acquired France’s Naturex, in 2018 for €1.3 bn at a sky-high EBITDA multiple north of 20x.

This is also the reason why another of its Swiss rivals, Firmenich, taking advantage of sales by 2 funds, first grabbed a 17% stake in Robertet at the end of 2019 for an average price of €683 per share. That holding was subsequently raised to 22% through open market purchases. Givaudan then upped the ante and bought a 5% ownership at above €800 per share.

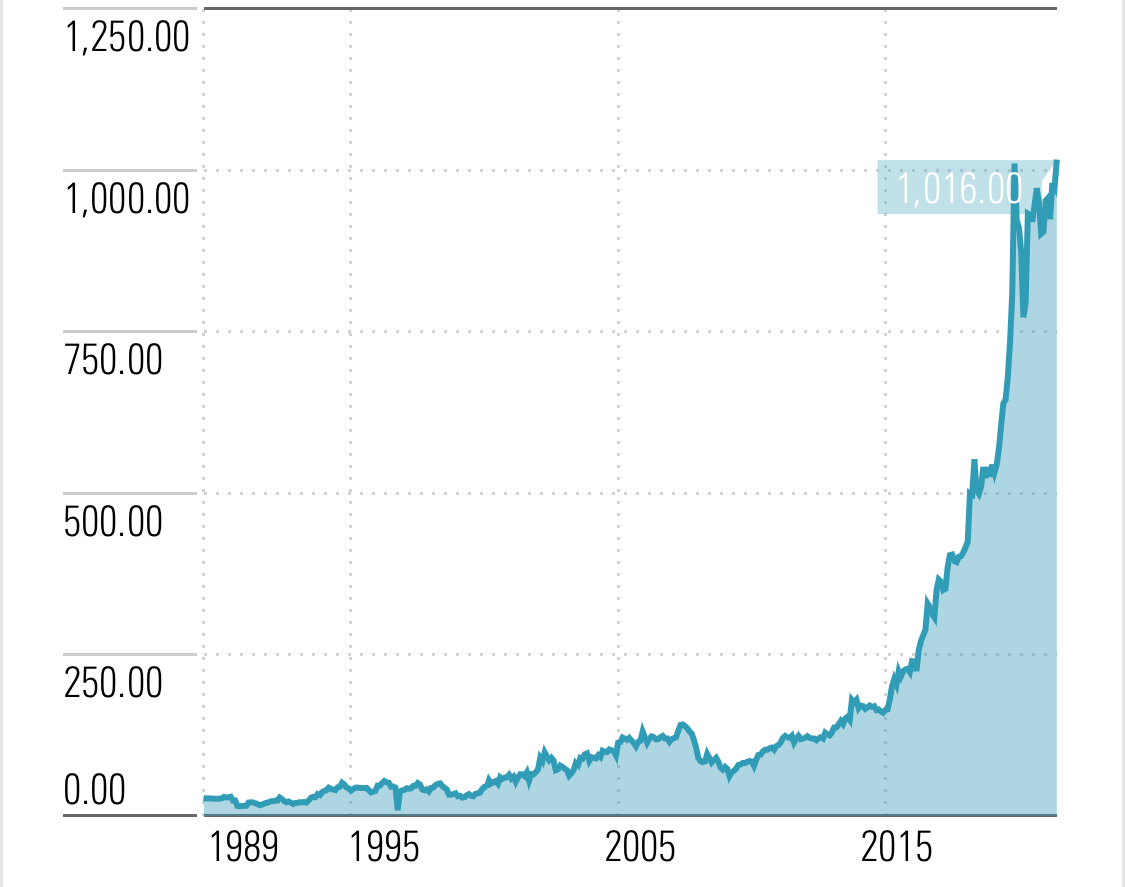

Philippe Maubert, 4th-generation Robertet’s family CEO, dampened its competitors’ enthusiasm and made it extremely clear that “Robertet’s independence is non-negotiable”. Meanwhile, speculation has fueled the share price that reached a peak of €1068 in February 2020 (€1016 as of today). That made the stock a 72x-bagger vs. its low of 1990.

Source: Morningstar

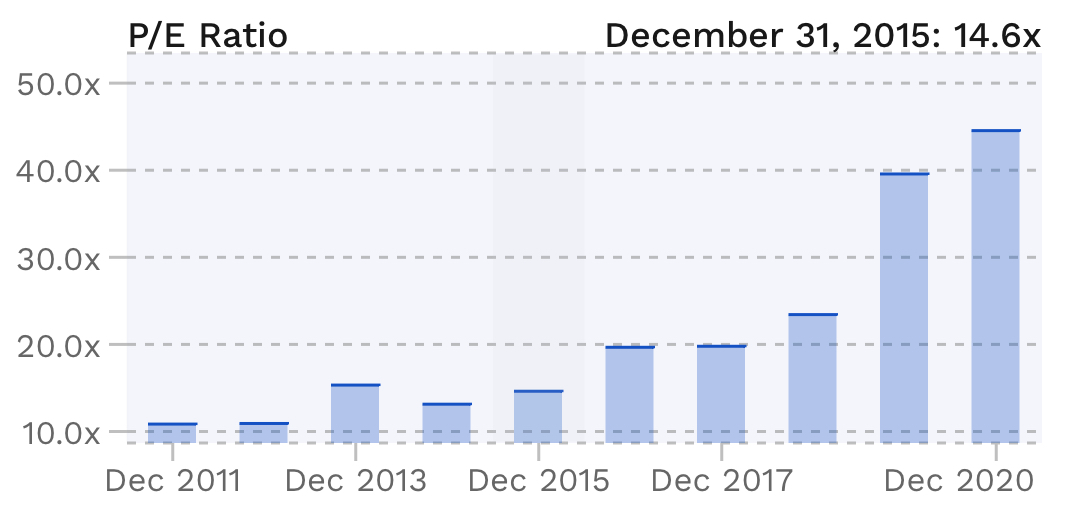

The company now enjoys a market cap of €2.5Bn for an EV multiple of 26x its FY20 EBITDA and a PE of 46 (vs. less than 15 in 2014-2015! We unfortunately missed the boat at the time). This very rich valuation, again, is due to Robertet’s status as a unique gem in a traditionally recession-proof industry. It is anything but cheap though!

Source: Finbox

The investment certificate (with no voting right) offers an alternative way to invest in Robertet at a 13% discount. That said, the discount has somewhat narrowed and the liquidity is so thin that building a sizable position is close to impossible.

Robertet is a high-quality company and one of us is already a shareholder. But at the current valuation, it might be worth waiting until it gets priced more attractively (if it ever happens again…) to start a position.

This article is a summary that draws heavily on a thread we had previously published on Twitter. In the follow-up posts of this series, similar to what we did for Precia, we will delve much deeper into Robertet’s business model, history, acquisitions and valuation.

Thanks again for reading / signing up and feel free to talk to your friends / fellow investors about our Substack. You can also reach out by email or by DM on Twitter @FRValue @FoxCastlehold. Have a great week ahead.

Disclaimer: The above article constitutes the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. Disclosure – we hold a position in Robertet at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).