EL Financial : a family holding accelerating its buybacks and with some self controlling loops à la Bolloré

NAV is Empire Life and lots of liquid assets (shares, holdings in publicly quoted companies…)

First of all, for this idea all the credit goes to Andrew Brown from East72 who made me discover this company. He did a great and in depth write up about the company here: E72DT-Quarterly-Report-Dec-2023.pdf (east72.com.au)

I will try to add some value but the task will be difficult!

They are some similarities with Bolloré with 1/ a self controlling loop and 2/ buybacks done by entities where EL financial is an important shareholder and which helps them increase their stake.

A self controlling loop à la Bolloré!

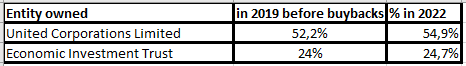

EL Financial owns 24,7% of Economic Investment Trust (a closed end fund) which owns 10,86% of EL Financial. We have a 2,7% self controlling loop.

To that there is within Economic Investment Trust some interesting holdings such as:

Ecando Investments Limited whose assets are primarily In EL Financial shares so we have another self controlling loop but we cannot determine it exactly as we don’t have access to Ecando’s accounts

The Fulcrum Investment company limited entity has a massive difference between its cost basis (464 KCAD) and its carrying value (32.9 MCAD). So this is only a guess from me and we can’t have access to its accounts

NGV Holdings Limited and TGV Holdings limited “are invested primarily in the shares of the Bank of Nova Scotia”: not impossible that they also hold some EL Financial shares.

The identified self controlling loop means that the true EL financial sharecount is at 3,37 million shares.

An acceleration of buybacks at all the different levels of the company

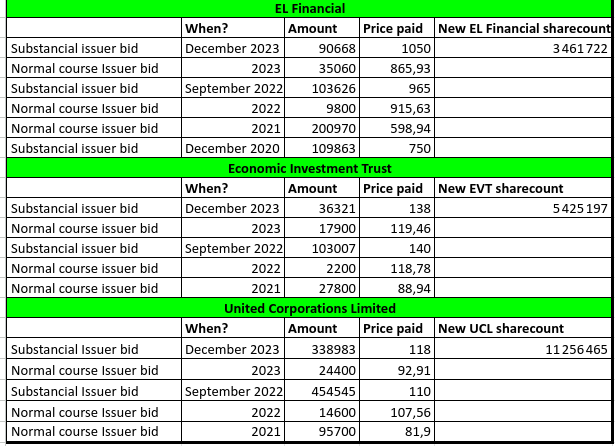

Since 2020 (what a timing!), EL Financial has initiated and has been quite aggressive in its buybacks. But what is also interesting is that it is also happening at the level of the different entities in which they are important shareholders (Economic Investment Trust, United Corporations Limited). This appears to be a common feature among the top family holdings (Bolloré, Exor Holdings and EL Financial).

Besides buying back shares because they are done below their intrinsic value (which we can say very conservatively is equal to their book value but more on that later). It is a smart way to increase their stake in holdings which they already know well and at a lesser cost as it the holdings themselves which are doing the buybacks and not the shareholder.

Buybacks at the closed end funds helps EL Financial increase its stake in their holdings

And these percentage do not take into account the buybacks which were done in 2023. There is also an additional twist with these buybacks: as Economic Investment Trust owns 10,86% of EL Financial each time Economic Investment Trust is buying back shares EL Financial is also reinforcing its hold on itself.

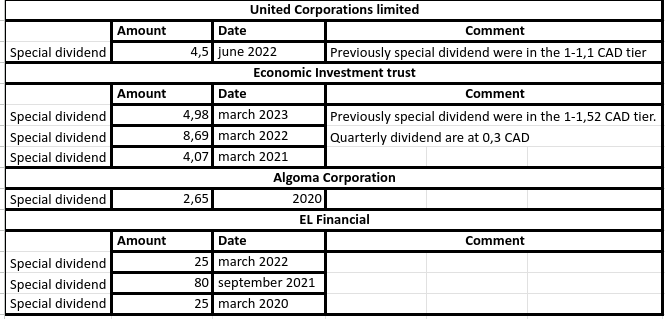

Since 2020 a trend of repeated special dividends

Special dividends were largely used and contributed to EL paying out special dividends as well.

Simplification of the asset funds managing the funds which brings about cost cutting which will boost earnings as time goes by

This happened both at EVT and at United Corporation limited. Management expense ratio decreased in both entities following these moves:

At 0.28% from 0.43% at EVT in 2022. Most of it is linked to a 1,6MCAD reduction in expenses due to the change of investment manager.

At 0.73% from 0.74% % at UCL in 2022; Here too most of it is linked to change of investment manager as expenses diminished by 2,6 MCAD.

And all this helps both in the performance of the funds (hopefully) and lower expenses helps boosts profitability which can be reinvested or paid out.

At United Corporations Limited, Neuberger Berman Canada took over a portion of the assets managed previously by Comgest And Harding Loevner. This can be probably explained by the respective performances of the funds. To be noted that United corporation was exposed to SVB Financial Group and First Republic Bank which resulted in 20,1 MUSD realized losses.

Annual growth in NAV are good at EL Financial, United Corporation and at EVT

Annual growth in NAV sits at:

- 9,1% between 2014 and 2023 for United Corporations limited;

- at 10,7% for Economic Investment trust and,

- at 12.5% since inception in 1969 and 11,2% since 2013 for El Financial. For EL it is the growth of the net equity value per share which is used to evaluate the annual growth.

Not too shabby!

Swings in Book value due to the accounting rules

A classic but we have a nice illustration here! Book value will be impacted each year depending on the performance of the share and bond prices. This can be seen through the FVTPL item (Fair value through profit and loss) NAV is classically understated as some holdings (UCL and EVT) are valued at market value and not fair value.