Catering International Services : a dynamic company which got its cash back from Algeria but…

… lots of small red flags

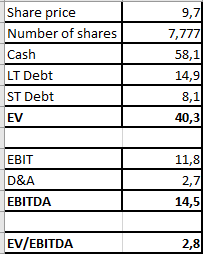

Share price: 9.7 €

MC: 75.4 E€

EV: 40.3 M€

EV/EBITDA: 2,8

Facilities management in extreme conditions

Catering International services offers all the services which are needed for a site to be operational (excluding the technical part linked to the specific industry). In other words, they take care of the food, the accommodations, laundering and security. They aim to take care of all the activities which are not core to the clients business. But it is facilities management in extreme conditions and/or extreme locations: in the middle of the desert... Their clients are in the petrol industry, mining industry. CIS’s expertise is to be able to recruit personnel, make sure that the supplies get there and that everything i working well. The company is now trading on Euronext growth (since 2022) as it transferred from Euronext Paris Compartiment C. Quotation on Euronext growth is less expensive and regulations are lighter.

A very good news: the cash in Algeria is no longer blocked which helps the EV a lot

On the 16th of October 2023, the cash which was blocked in Algeria since the 7th of may 2017 was finally unblocked and transferred back to France. It represented 65,7% of the total cash position in 2022. Needless to say that it was a massive news. Previously this cash could not be taken into account in the EV calculation or for the least, a big discount had to be applied on it. When you have a 75,4 M€ market cap and a 35,1 M€ net cash position well you get a nice 40.3 M€ EV.

Some sales growth… but no growth in EBIT margins

But all in all EBIT margins have not increased in the last 9 years and sits at 3,6% in 2022 which is below its 9 year average. The explanation can be multiple: big contracts are signed but the clients have the bargaining power, cost of setting up operations in extreme conditions are high and cannot necessarily be passed on to the clients.

It has always been a key issue with CIS: can they improve their margins as they grow bigger? The answer seems to be no for the time being… and this could explain why the valuation is cheap and remains cheap.

Too many regulated agreement

Regulated agreements are specifically validated by the external auditors as they are agreements which have been signed between the company (A) and another company where a top manager/owner from company A has an interest.

There are eight regulated agreements for a total of 1,2 M€ which represents 10% of the EBIT. Six regulated agreements are linked to real estate. In France, it is a common practice for the owners of a quote company to set up a dedicated real estate entity which owns the real estate. This real estate is then loaned to the company, which pays a rent. Once can perfectly do that, it just is always weird in my opinion when the real estate is not owned by the company which is using it.

Two regulated agreements are service agreements with one representing 0,8 M€. A service agreement means that the company pays a company which belongs to the owner/major shareholder of the quoted company for the service he or she is performing for the company. Once again this is completely legal and possible. It is just that I would rather have that paid as a wage directly at the company level.

Forex strongly impacts financial results

As CIS does most of its business outside of Europe, there can be big swings in the financial results.

Here is an illustration of the impact of the forex on the total forex numbers:

Forex effect clearly determines what the financial results will be.

Moving on financial results could be helped by higher interest rates which will boost the remuneration of the big cash position.

Pareto law applies: some subsidiaries explain most of the profitability

Before 2020 we had the details of the results for the subsidiaries but it is no longer the case. CIS now only gives us the numbers by region.

Nevertheless let us have a look at the 2019 numbers, here is what we have got:

The top 4 entities which have a strong profitability :

CNA (Algeria): 100% controlled with 3,5 M€ net profit.

SSM (Mongolia): 49% controlled with 2,2 M€ net profit.

TSC (Democratic Republic of Congo): 100% controlled with 0,9M€ net profit.

CAC Kazakhstan: 100% controlled with 0,8 M€ in net profit.

The 3 major loss makers are:

ACS (Russia): 100% held with a 1,6M€ net loss.

CIS Arabia: 55% held with a 0,9M€ net loss.

CIS MEA: 100% held with a 0,4M€ loss.

Algeria has always been a very profitable market. There is 6M€ in goodwill linked to its acquisition in 2006 which helped a lot CIS. They have a historical presence over there and can explain the high level of profitability.

Penalties on contracts tend to repeat themselves and impact EBIT

Penalties will happen as CIS is working in extreme conditions so it is bound to happen. Yet it does represent a non negligible hit on the EBIT. I found it to be an interesting indicator to follow. Unfortunately, it tends to repeat itself so we cannot say that it is a one off.

Valuation: not expensive at all and possible sale by the founder but they are a couple of red flags

The share count takes into account the 0.263 M treasury shares.

The founder is 85 years old so it is possible that at one point the company could be sold. Also a new governance was set up in 2022. Now the founder is the chairman of the board with the COO becoming the managing director.

IFRS 16 is clearly put forward which helps us easily distinguish what is IFRS 16 related and what isnot. It is still rare so it needs to be put forward!

Clearly CIS is not expensive so the question is why? I see the following points:

lots of regulated agreements

Board of directors gets nicely paid

No growth in operational margins

Cheers!

Jeremy

In the meantime, thanks again for signing up and feel free to talk to your friends / fellow investors about the French Hidden Champions Substack. You can also reach out by email or by DM on Twitter @FoxCastlehold Disclaimer: The above article constitutes the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. Disclosure – I do not hold a position in Catering International Services at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).