Bolloré: a second independant expert report with lots of incredible/unbelievable points to justify the fairness of the ex-rivaud take out offers

Doing a forensic of an independent report brings about lots of questions!

So the time has come to rebutt many points put forward by the second independant report. Once would have thought that after the first independant expert got rebutted by the AMF (french regulator) for lack of independance (a historic decision!) that the second independant expert would have done a thorough job.

Rest assured it was not thorough and I still can’t believe all the justifications which were used to determine that the take out offers were fair.

Remember that we are not in a tender offer but in a take out offer which is considered as an expropriation in France. As such a fair value must be offered to the minority shareholders. Indeed in a take out offer if it goes through you have no choice but to bring your shares to the offer. This implies a true valuation of the companies which are being take out. In a tender offer, as shareholders do not have to bring their shares the independant' expert’s report does not have the same role.

Here we go are all the inconsistencies which I could find in the report!

These are the first elements I will be sending the AMF (french regualotor).

I will probably diffuse a lot fi these elements to make as much noise as it is possible. Once again if these take out offers go through, minority shareholders rights will take a serious hit in France…

Share price cannot be considered as the fair value of a holding or of an asset

As soon as there an asset or a holding to be valued, the expert uses a weighted average share price on different time frames (Spot, 20 days, 3 months, 6 months and 12 months). Since when does the share price or the weigthed average share price represents the fair value of a company. This cannot be considered as an evaluation of a company and it holdings.

First illustration of this approach is here:

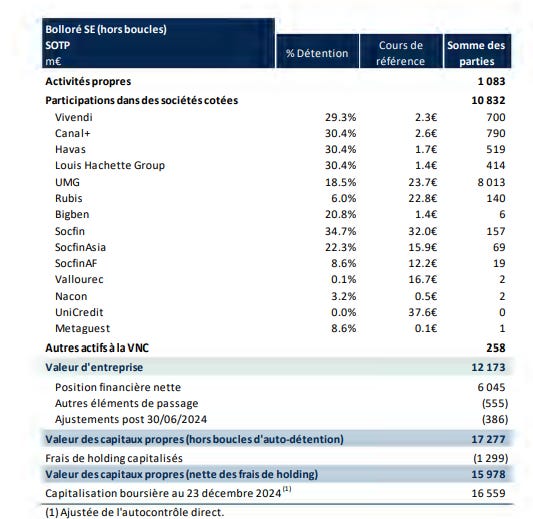

Another illustration is the following table which is the valuation of Bolloré given by the expert. He uses share price for all the assets… And once again share price is not the fair value….

For UMG, even though there are 16 analysts following the company who get to an average valuation of 27,5 € well the expert keeps the current share price of 23,7 €…

So even if a company is widely followed by analysts their valuation is considered to not represent fair value. It seems that as soon as the share price is not used a valuation will be discarded….

Even for the sum of parts approach the expert uses share price for the quoted holdings!

Not a single time has the expert tried to value the different holdings bu trying to value them by multiples, comparables…. he only uses share price…

The self controlling loop is not valued at all because of course treasury shares have no value… sure…

The independent expert values a Bolloré share at 6 € by not taking into account the self controlling loop! And as the market values Bolloré at approximately at the same price well then the market does not give any value to the self controlling loop.

So once again market share price is considered to be the fair value….Remember we are in a take out offer which expropriates minority shareholders. A fair value must be determined which implies a valuation.

Share price cannot be considered as fair value. A solid evaluation must be done to determine a fair value.

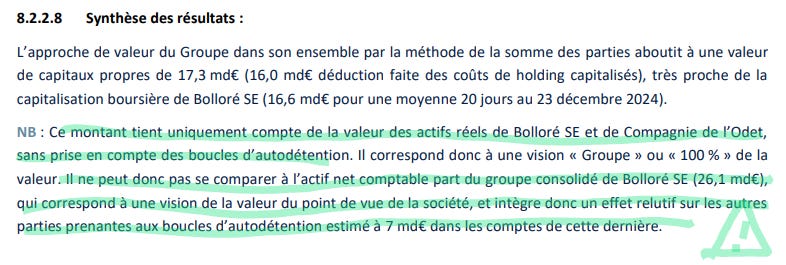

According to the expert: book value per share cannot be used even if it represents a vision of the value of the company which is given by the company itself and takes into account the self controlling loops

This is most certainly the worst justification I have seen :

A consistent willingness by the expert to never take into account the self controlling loops as it would add by itself 7 billion euros in value.

The expert does not want to take the value given by the company itself! Wow that is impressive: the company knows itself well but the expert considers that he knows better than the company.

Book value per share is the most objective indicator to value a holding company such as Bolloré and the book value per share is at 9,2€

Equity group share is at 26 110 M€ and the share count is at 2 841,8 million shares. This gives us a 9,2€ per share. These are objective items given in the consolidated accounts of the company.

What is interesting too is that at the Bolloré level there are only 15,3 Million trasury shares so its impact on the book value per share is quite low.

And we know that the self controlling loop is above 50% or higher within the galaxy while at Bolloré itself ithen the self controlling loop used at the Bolloré level….

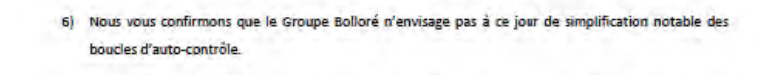

There is no specific length given by Bolloré to not simplify the galaxy if the take outs happen

In the annexe 8.5, the Bolloré company just says it will not simplify after the take outs but there is nothing binding as there is no length put next this promise. If the take outs were to go through, it shoud be required that Bolloré writes a written committment to not simplify for 5 years. I am sure that it woudl change things quite a lot as the aim of these take outs is to simplify the galaxy and regroup the cash….

Here is the extract of the letter of affirmation where there is no duration of the committment indicated:

The expert does not like to put forward the good elements especially when it is a strong increase in the equity group share

You will not that the expert does not put forward this increase either in percentage (+13,1%) and + 3 035 M€ in only six months…

There are other points which I will put forward in other posts.

Cheers!

Jeremy

Disclaimer: The above article constitutes the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. The author may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. Disclosure – I own Galaxie Bolloré shares at the time of publishing this article (this is a disclosure and NOT A RECOMMENDATION).